Healthy industries have several. Who will step up in the energy transition?

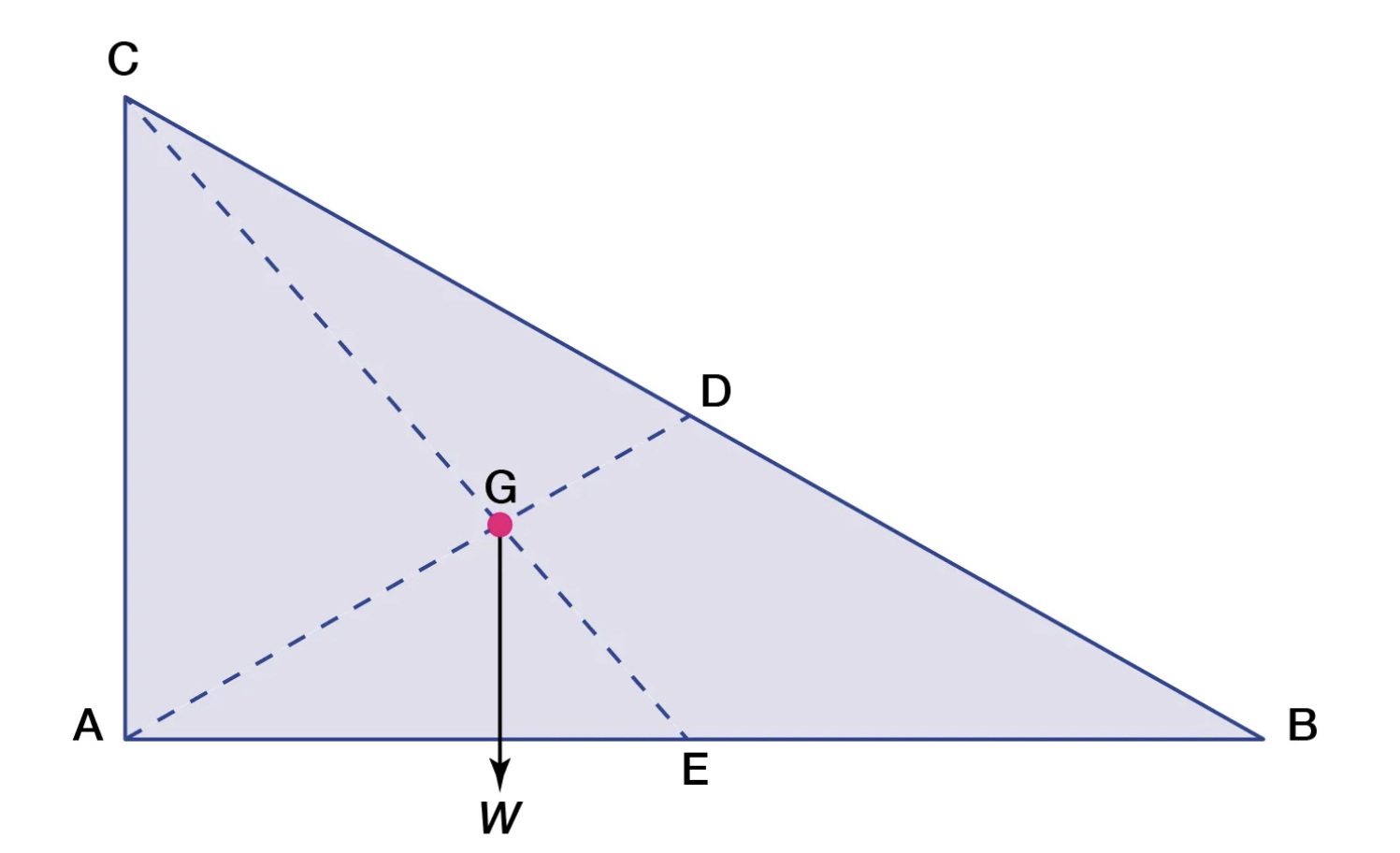

We use the concept of a “center of gravity” in physics to predict the behavior of a given body when gravity acts upon it.

Lately, I’ve been using this framework to think about what the exit landscape could look like within the energy transition and broader digitization of industry themes.

Most software sectors have several prominent centers of gravity as the main potential acquirers. These are the companies you know will become acquisitive if a competitor or complementary company grows to scale. The healthiest industries have 2-4.

These are the firms that lower to middle-market PE investors can look at and say, “If this goes well, we have 3 obvious landing spots that will pay a premium for our investment.”

Cybersecurity has Palo Alto Networks, Zscaler Crowdstrike. IT has ServiceNow and Snowflake. Construction has Autodesk, Hexagon, and PTC. Microsoft acts as a center of gravity in several industries.

The next step of maturity for technology within the energy transition will be finding these obvious homes that will come to the table for scaled assets.

Firms like Honeywell, Emerson, Schneider, Rockwell Automation, and GE Vernova make sense as eventual centers of gravity for the space. Mega PE will also act as temporary centers of gravity in the space. Blackstone, TPG, and KKR established funds to own the best energy transition assets.

The next 24 months will be more active on the M&A front. I suspect we’ll see a few big corporations attempt to plant their flag as the best home for scaled energy transition assets.