The energy transition is full of deployment, recycling, and retraining. Playing these trends effectively can be a key to success.

Investors like Bill Gurley and Josh Wolfe cite Thinking in Systems as one of the most impactful books they’ve ever read.

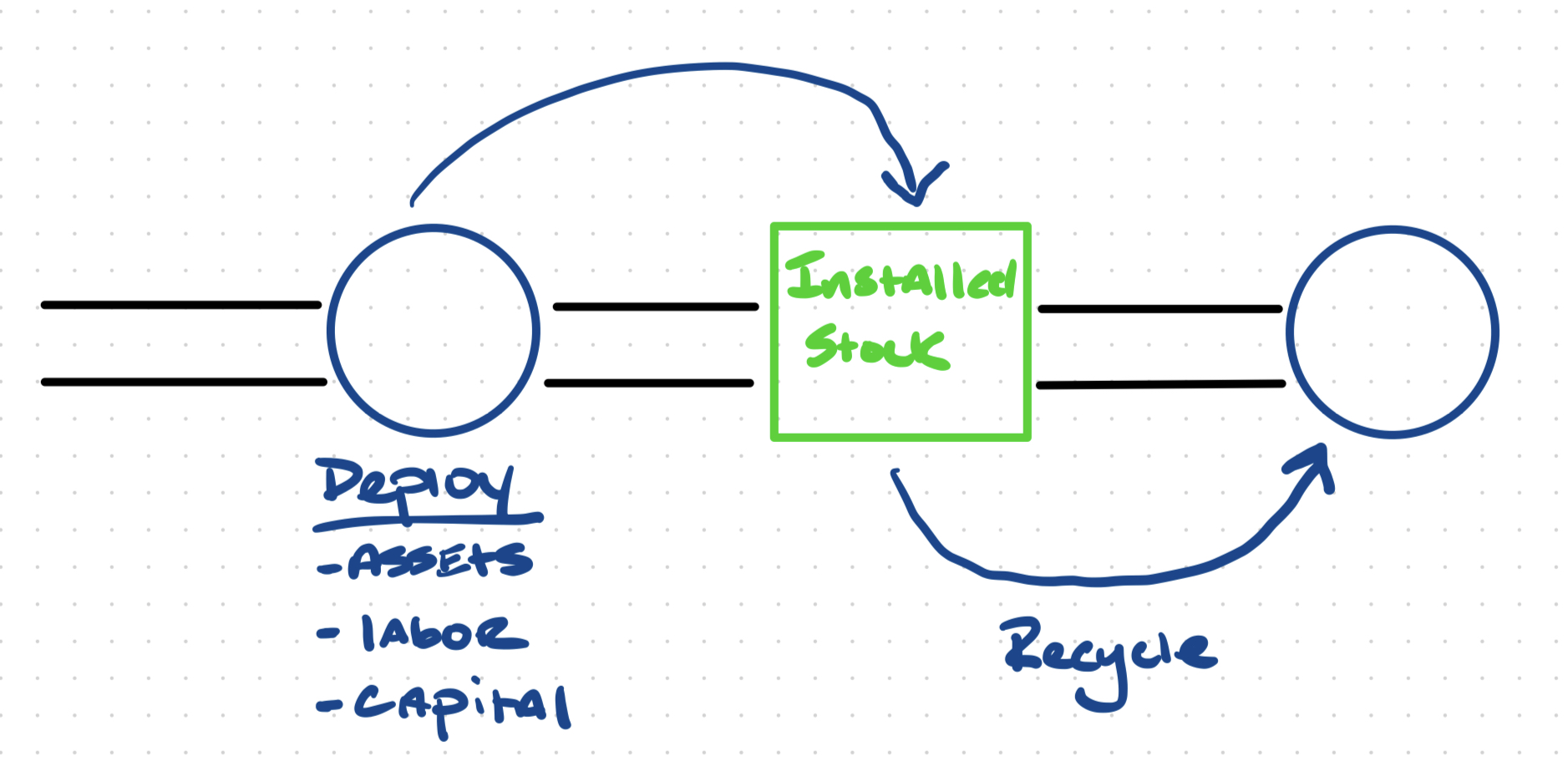

A key concept from that book, and one that I’ve been thinking more about lately, centers on the stocks and flows of a given system. The energy transition is full of examples.

New assets like solar, batteries, data centers, and EVs create massive “in-flows” as we deploy those assets at record rates.

The stock consists of existing generation, transmission, and the labor servicing them.

And, soon, we’ll see outflows of assets that are being retired or recycled.

Matching your business to the appropriate part of this cycle can create an unexpected edge. Mismatching can result in disaster or at least slow growth. For example, the environment remains challenging for startups seeking to build O&M solutions for asset categories with small installed bases.

Flow

The easiest way to think of flow in our context is to tie it to deployment to grow the stock and retirement or recycling to shrink it.

Not all flows are created equal – think of a faucet drip vs. a water line break—velocity matters. As I’ve said, “The game you play is more important than how you play it” – this is the company-building version.

The asset side of the energy transition remains firmly in the deployment phase thanks to solar, storage, and EVs. Boosted by AI, data centers will also stay in the deployment phase for the next several years. Startups indexed to flow should quickly achieve product-market fit if their solution solves critical pain points.

Recycling is another great example of flow. Recently, firms within the circular economy have gained more traction as the stock of certain goods needs to flow into new uses. We’ve seen firms like Redwood Materials and Solarcycle have success in batteries and solar, respectively.

Stock

Unlike flow, stock is more intuitive to understand. It is the installed base of a given market’s assets, labor pool, or existing population. So long as in flows are greater than out flows, stock goes up. The magnitude of the difference determines the velocity of stock growth.

As startups grow and mature, investors increasingly consider metrics like gross and net dollar retention to evaluate the health of a company. In addition to continually solving deployment issues, one great way to grow these numbers is by creating value attached to a growing stock.

Over the last year, we’ve seen several companies indexed to the existing stock of energy assets prove to be extremely sticky. These firms usually fall into the categories of operations and maintenance, analytics, and systems of record.

Firms that service/manage EV chargers, provide portfolio-level views of solar and storage, or keep records of installed infrastructure continue to grow in importance.

Stock Meets Flow

The graph above is an oversimplified version of stocks and flows. In reality, many stocks and flows interact with one another. Retraining labor for new industries highlights this example.

There are three ways to solve this problem using the stock and flow framework.

Create more flow by training new workers to grow the installed labor base. Population growth eventually limits this flow’s velocity as only so many workers enter the market at a given time.

Improve productivity of the installed base of labor. Do more with less. This one has worked in industries where software created exponential efficiency gains.

Steal from other tangential labor pools. We could, and are trying, outflow labor from incumbent industries and re-direct it to create an inflow of labor to next-gen energy transition industries. The graph above illustrates this.

So far, #2 has proved the most successful. But, we continually see new solutions arise for #1, and new policies like the IRA could accelerate #3.

Stocks and flows are not mutually exclusive. The companies that index themselves to both at the right time do incredibly well.

Software can accelerate deployment / flow and thus revenue, THEN enable new revenue or reduce costs with solutions for a large stock of assets. In that case, you have created an end-to-end solution for some of the most important customers in the world.

And, after all, isn’t that what we’re here to do?

PS: Thanks for dealing with my terrible art.